Financial reporting

Q38 - Earthstor:

Traynor Co Suffered cash flow problem.

1 Jul 20x5 - interest free loan MYR20m repayable 30 Jun 20x7 (2 years)

MYR5 = £1, average rate =5.5, YE rate =6

Loans EIR of 6%

Henrymin agreed to sell 10% shareholding of TraynerCo to Earthstore for MYR45m 1 Oct 20x5

Loan to Traynor is a financial asset for Earthstor

IFRS 9 financial asset

Measured intially at fair value - 20m/(1.06)^2 = 17.8m/5 and translated to £3.56m

20m/5=£4m less £3.56= £0.44m is recognised in trade and other receivables and £3.56m recognised as expenses in P&L

Zero interest rate loan issued at par - not result in arms length transaction and IFRS9 requires to be determined as the PV of cash receipts under EIR method.

Discount rate should be similar to loans

Loan meets the business model test and contractual cash flows test being the initial fv and interest being interest accrued using EIR

Subsequently measured at amortised cost

Each year the unwinding treated as finance income 30 Jun 20x6 = 17.8m*1.06=18.87mMYR

Monetary asset and translated at YE £1=6MYR then - 18.87/6=£3.15m

Finance income recongised at the effective rate - as the interest accrues over time - it is translated at the average exchange rate

17.8m *6%=1.07m translated at average rate = 1.07m/5.5=£0.2m Translated at YE rate 30 Jun 20x5 =1.07m/6=£0.1783

Difference = exchange loss on the interest of £0.02m

exchange loss on the loan

17.8m/5 less 17.8m/6 = Difference is £0.59m

Hence the finance income= £200k less exchange loss on interest and loan (610k) Gives the negative (410k)

Current loan is recognised as MYR20m/5=£4m and should be recongised as £3.15m

DR finacnail assets £3.15m YE

CR trade receivables £4m

DR exchange different £610k

CR finance income £200k

DR finance cost £4m-3.56m=£0.44m

Website development costs

Launch on 1 May 20x6 new website - provides future benefits to business for 7 years.

YE Jun20x6 - dev costs in intangible assets

Planning costs: 3m, prof fees £1.3m, Fee paid for brand £5m, internal software dev costs £22m

Cost of acquiring and developing the software should be capitalised separately as intangible asset under IAS 38.

BUT website development and maintenance costs - should be expensed as incurred

IAS 38 - intangible asset should only include costs that are deirectly attributable to preparing the asset for use leading to future economic benefit

Capitalised software costs can include external direct costs of material and services and payroll for employees who are assicociated with project

Capitalised software development costs provided meet the criteria - IAS38 - costs integrate the websites with other process systems of business not merely for content and advertising - stated at historic cost less accumulated amortisation

Amortisation calculated on straight line basis over assets expected economic lives. Amortisation included in admin costs in SPL

So E has incorrectly capitalised the planning costs, also possiblit fees paid to T and photography and graphic design costs. These costs should be expensed during the year. Amortisation is 22m/7years*2/12=£524k required to be charged from 1 May 20x6

DR opex £3m+1.3m+5m+524k =£9.824m

CR intangible assets £9.824m

Q39 - EyeOP 31 Dec YE

1 Dec 20x4 Hi bought 50k of 1m shares for £700k

irrevocable elction recognise valuation gain/loss in OCI

30 Dec 20x5 - FV 50k shares was £2.5m (increase £1.8m)

Hi intends to buy further 650k shares on 1 Aug20x6 for £85m (FV of net assets expected £63m)

1 Aug 20x6 original shareholding FV expected to be £6.2m

FV paid to acquire is £85m

NCI interest is FV net assets 63m*30%=18.9m

FV of previous net assets = £6.2m

Gives 110.1m

Less the FV of all net assets (63m)

Gives Goodwill of 47.1m

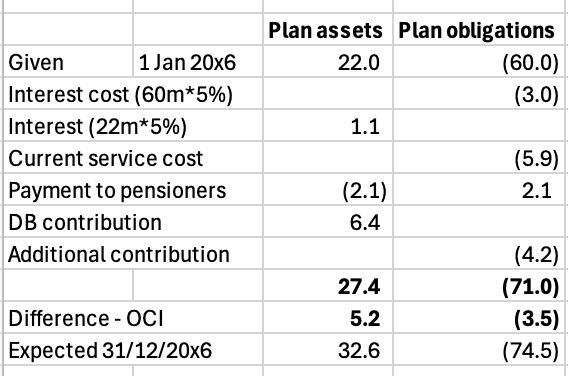

Pensions scheme: 2 schemes. Total contribution paid £9.2m recognised in admin expenses

A: Eye made contribution £6.4m to scheme A YE 31 Dec 20x6. Directors/ee working >5 years, Eye has contractual obligation ensure contributions are sufficient provide pension to scheme members. Average 3 years salary.

B: contribution £2.8m. Contribution create right portion of scheme assets used to buy annuity on retirement. contribution fixed at 7% of annual salary for employer and 3% for employee

Pensions assets 22m, PV of oblig (60m) gives post employment net benefit (38m)

YE 31 Dec 20x6 - 15 employees redundant and EyeOp commit pay additional pensions to employees - contributes additional £4.2m to pv of pension obligation. Valuation of pension scheme assets and pV of pension obligation at 31 Dec 20x6 expected £32.6m and £74.5m

Yield of corporate bonds 5% pa, current service cost 5.9m, benefits paid to former ee is £2.1m, actual return on scheme assets £6.4m

No adjustment made in P&L except of recgonition of £9.2m in admin

Scheme B is Defined contribution scheme - there is no obligation on Eye other than to pay it’s contribition of 7% to the pension fund

Scheme A is defined benefit plan because EyeOp has provided a guarantee over and above obligatios to make contributions. Hence the contribution of £6.4m should be credited from P&L and debit to net benefit obligation.

Current service cost of £5.9m and finance cost £1.9m should be charged to P&L

Gain on re-measurement must be calculated and taken to OCI

ADjustments

Finance cost - Plan oblig(3m)-Plan assets(1.1)=£1.9m DR finance costs 1.9m CR net benefit obligation 1.9m

OPEX current service cost(5.9m) + additional contribution (4.2m)=10.1m DR OPEX, CR net benefit obligation

Contribution 6.4m DR net benefit oblig CR opex (reversed from P&L)

Gain on remeasurment is the diff(5.2-3.5=1.7m) CR OCI and DR net benefit obligation 1.7m

IAS19 - the interest is calculated using the net benefit obligation - meaning the amoujnt recognised in P&L is the interest charge and the interest income of assets. The actual return shouldnt be in P&L,

Medical imaging camera

I oct 20x4 new imaging camera - Dev costs £4m/month incurred from date until 1 Jan 20x6

1 Jan 20x6- made breakthrough - deemed financially and commercially viable and thereafter development costs decreased to £3.5m/month

Marketing and production begain 1 May 20x6

Marketing expected receive orders 600 cameras £60k each in YE 31 Dec 20x6

non-refundable payment of 25% of selling price on receipt. (non canellable)

50 comeras manufactured in YE who pay EyeOP, the remaining 75% of selling price in Jan 20x7

Anticipates 4 years life, sales of 3.5k cameras - anticipated 875 cameras delivered YE 20x7.

VC is £22k per camera

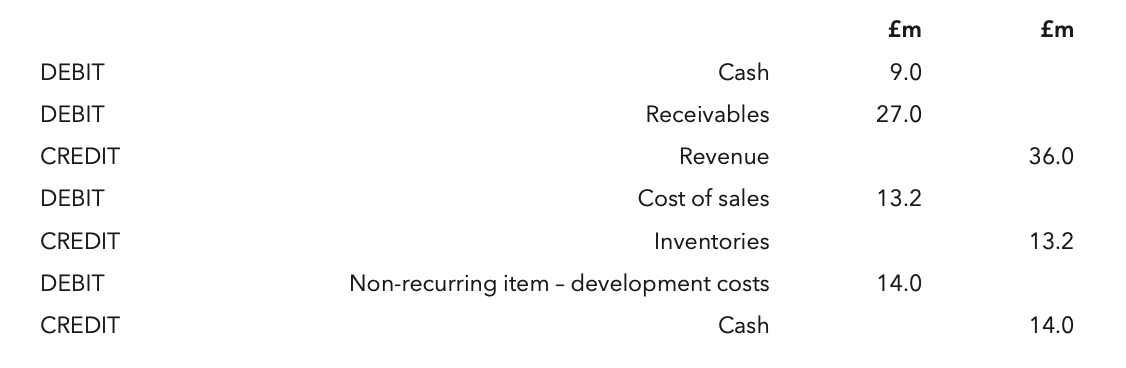

Intended to recognise revenue 600 cameras -

Wrong to expense the develpopment costs

Before 1 Jan 20x6 - project not viable so should expense £4m/month - this is the right treatment as probable future economic benefits uncertain before the date

But after 1 Jan 20x6 where breakthrough - the project is viable so capitalise = 3.5m/mth*4mths (Jan -Apr)= £14m (intangible asset) and amortise once product in use May 20x6

DR intangible asset 14m, CR P&L 14m

Commenced production May 20x6 ==the development costs should be amortised - 50 manufactuered out of with 3.5k cameras*14m=£200k

DR OPEX £200k CR intangible assert 200k

Intends to recognise revenue of 600 cameras = customers order by 31 Dec 20x6 - because non cancellable but IFRS 15 - revenue from contracts with customers - revenue should only be recognised when performance obligations in contracts are satisfied. There is only one performance obligation of supplying the cameras

performance obligation is satisfied when control of cameras transferred to buyer. _ upon delivery so revenue of only 50 cameras should be included in SPL 50*60k=£3m -(550 not delivered) so show as not revenue yet

They recognised 600 cameras £60k =£36m but actually should only be £3m of revenue so remove 33m

DR revenue of 33m

deposits received 550—so remove that: 550 cameras* £60k *25%=£8.25m - should be contract liability CR 8.25m

Remaining 75% of price due after delivery — 550* 60k*75% = £24.75m

Shuold not be receivable because goods not delivered so need to remove the debtors = CR 24.75m

Cost of sales should be removed from original journal of 22k VC*550 cameras = £12.1m

DR inventories 12.1m CR cost of sales £12.1

HiDef had 5% and then Buying the 650k shares in EyeOp gives 70% on key performance targets 30 Nov 20x6 and 20x7

HiDef held shares in EyeOp as only investment before, Hidef made a irrevocable election to revognise gains and loss in OCI so that investment was classified as FVOCI

But then HiDef obtained another 650k shares so acquired control EyeOp becomes a sub

Previously classified as FVOCI so any gains previously recognised in OCI may not be reclassified from OCI to P&L and gain arising on derecognition is also recorded in OCI

So you dispose of the old investment and then reacquire it at FV

Remeasure the old investment any gain/loss goes to OCI

Not recycle the gain from OCI to P&L

And then consolidate EyeOp as subsidiary

Have £6.2m already recognised. FV acquisiton date was £2.5m

FV net assets expected £6.2m less FV net assets last YE £2.3m = 3.7m

DR Investment £3.7m CR OCI £3.7m

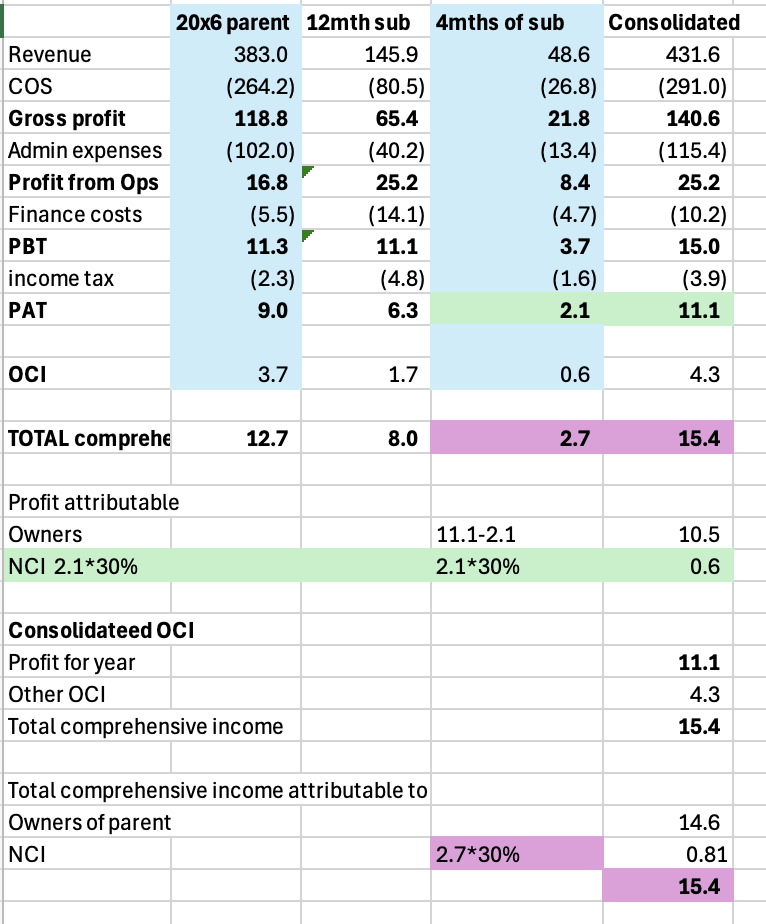

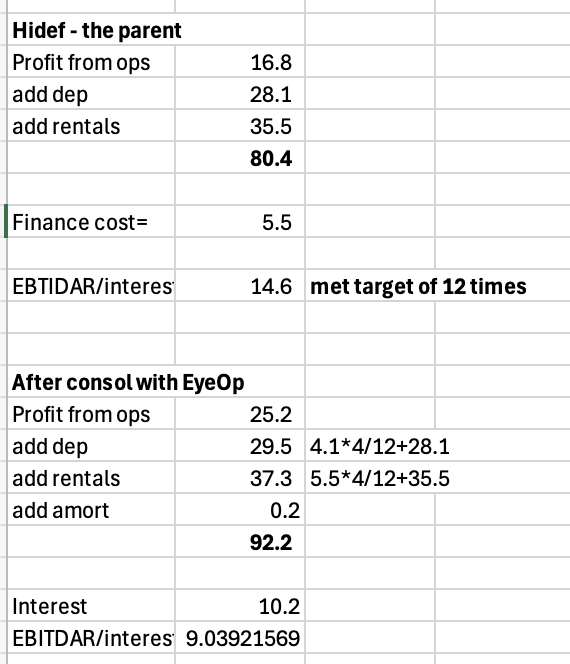

Analyse the impact of purchase of 650k shares in EyeOP on HiDef’s key performance targets for YE 20x6 and 20x7

Revenue YE 30 Nov 25: £400m and expected rev growth 7% per year, GP % greater than 35%, EBITDAR/interest is greater than 12

When consolidated the revenue = it has met their target for YE 20x6

£400m*1.07=£428m (projected revenue was £431.6m 4months)

Gross profit:

Hidef parent gross profit of 31%

EyeOp subsidiary had 45% gross profit

After consolidation: 4mths EyeOp+Hidef Gross profit margin = was 140.6/431.6m= 33% which is below the target of 35%

Medsee -

anticipate in 4 years 3500 cameras sold = so one. year = 3500/4=850 cameras*60k=£52.5m revenue

cost of sales 850*22k vc=£(19.25m)

Gives GP of £33.25m

which is 63% GPMAnd to remove the medsee contract - they remove (50cameras *60k=£3m revenue, 50cameras * 22k =£1.1m = £1.9m gross profit

Gives the 45% gross profit

Directors should question if the Medsee cameras 63% gross margin achievable. EyeOp business only achives 44%, This might not be realistic as there could be extra fixed costs that could cut into that margin.

30 Nov 20x7Revenue - 50 cameras plus 3500/4 cameras plus parent revenue

Less cost of sales

Gives gross profit

37% is higher than 35% target

Q40 Topclass Teach

Lease:

identifiable assets,

does customer right to obtain substantially all economic benefits from use of asset throughout period of use,

right to direct how and for what purpose the asset used, does customer right to operate asset throughout the period of use without supplier having the right to change those operating

TT sells surplus land £3m carrying amount, £5m proceeds

B build 2 assets - hotel (operated by B) and a management centre (exclusive to TT for 15 years)

TTpays £300k pa for cente and services (cleaning, maintenance, security) (100k relates to staff services)

Hotel

is not a lease as TT has no control, no right to direct use and no obligation to take rooms

Management training centre

is a lease as TT has exclusive use, direct activities, benefits economically.

Half of the land which has been sold will be used for the hotel and TT has no right to re-acquire that land and no lease over it during term arragenemnt

Elecment accounted for as disposal resulting carrying amount £1.5m and recognition of profit of £1m Further info needed assess price of land FV

Sale and leaseback of land

PV of future lease payments cannont be calculated without elemenets of payments relates to cleaning, maintennce, security and reception service provided

Cost of building is £4m (excluding £100k pa relates to staff costs/services) future lease payments is (15(£200k)=£3m

Covers the elase of land £3m*4/6.5=£1.85m related to buildinf before discounting

FInancial reporting

Land sale for management training centre treated as sale and leaseback under IFRS 16 - with gain recognised on rights transferred and right of use asset of rights retained

Carrying amount *PV/FV

Training centre - new lease as building not exist at time of sale, Right of use asset set up consist of the discounted PV of future lease payments